Open Collective Inc - Investor Update 2023

As we leap into 2024, let’s reflect on the past year's journey. Explore the highs, the challenges, and our strategic vision for the future!

This is our 2023 update for our Investors by our CEO, Pia Mancini.

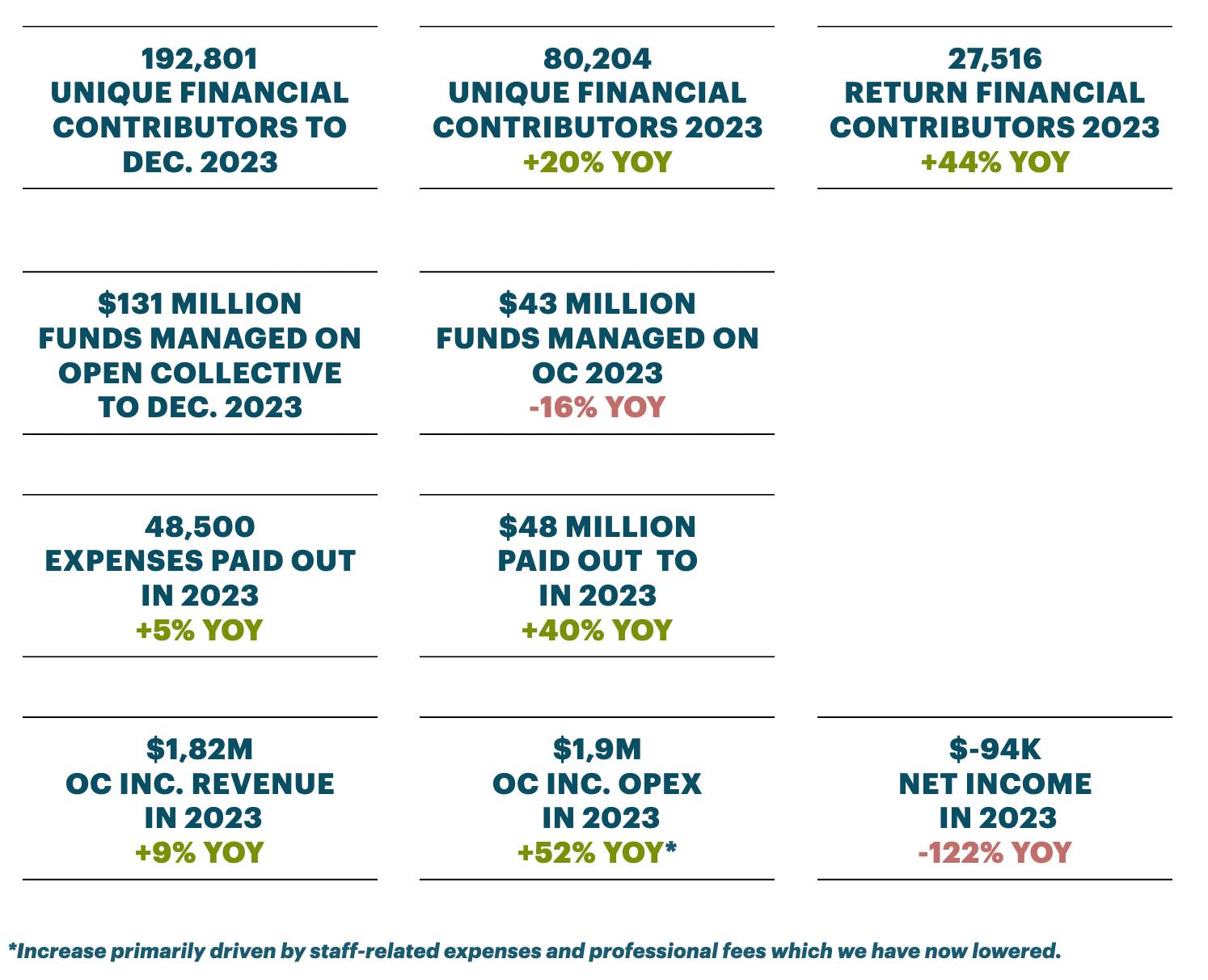

Hope all is well and you had a good kickoff of 2024. I want to share with you the latest news from our corner of the world. 2023 was a challenging year for Open Collective. We have seen a decline in the growth of funds contributed to collectives compared to 2022 that spans across our main verticals (Open Source and Solidarity Economy). The pandemic and Ukraine war solidarity efforts that helped us scale substantially have waned and the contraction in tech and startups funding has taken a toll in open source contributions (5M below our projections from 2022).The previous years’ growth expanded our operations and as a result we’ve ended the year at a loss for the first time since 2020. The loss is not significant (~100k) and we still have about 1M in the bank, a very long runway for this yearly burn rate. Notwithstanding, we have implemented some measures to reduce cost in case 2024 continues the trend and to give us a better chance to carry out the pricing changes we need to do (more on why we need to make changes in the business section below).

2023 in Numbers

Product

In 2023 the product focus was to transform the Open Collective platform from an incidental to an intentional workplace. There are people for whom Open Collective has become the place-of-work and we would like to make it a pleasant and effective one. Fiscal hosts are the groups who spend the most time on the platform so our attention was focused on them. In 2021 we deployed a strategy to help our partner hosts grow more effectively and we have been investing in building features that will help them better navigate their work. This strategy showed results (our partner hosts grew substantially) and also brought about challenges (we found the limits of how much we can help them grow sustainably, more on this in the business below).

Over the course of the year we built out their dashboard experience (reorganized and enhanced its tooling, introduced a personal timeline and evolved a better and more consistent experience, better expense and payment processor management, notification management search tools and hosted collectives management). We also implemented an optical character recognition to make the expense experience more agile. We developed features to enhance the accounting readiness of the platform data (more powerful CSV export, chart of accounts functionality and a vendor management tool). See here a writeup of product for 2024.

We’ve also built security improvements like a password alternative to the login magic link and better 2FA support with security keys. We expanded on payment sources with contributions using ACH and SEPA as well as Apple and Google Pay.

Business

As you can see in the numbers section above, while the absolute number of contributors increased last year, the amount of money being donated has decreased 16%. The key to understanding this is the significant shift in the origin of those contributions over the last 4 years.

The financial contributions Collectives receive has moved from individual contributions via crowd-funding toward institutional support directly via the fiscal hosts’ bank accounts. I’ll explain briefly: from 2015 to 2020, Open Collective was primarily a crowdfunding platform, where OC INC received a percentage fee taken from each donation. A few years ago, we introduced a feature called Added Funds to help hosts use Open Collective to track direct bank transactions and in this way maintain a centralized budget for their collectives. We saw the value in this approach and intentionally started driving larger donations to the hosts (i.e., Funds for Open Source). We did not have a separate business model to capture the value created with this and other related features so we simply copied the % on the transaction we had for crowdfunding.

In the graph below, you can see how, over the last three years, the source of funds on the platform shifted majorly from small donations to added funds. A mechanism that was originally an unplanned “add-on” became the main source of our revenue, shifting our incentives and, slowly, our strategy, in a way that we did not plan for, and I failed to predict. As a result of this movement to direct-to-hosts large grants and funds (with their increased compliance and opex); the cost to hosting collectives while equally sharing the fee on the transaction became untenable for the fiscal hosts.

This is prompting us to shift the way we price our solution in order to grow. We need to review our agreement with our main revenue generating hosts to allow them to be sustainable while buying us time to increase the number of organizations using the platform on a lower pay scheme to make up for this change and scale. We have always charged on money coming into the platform, understanding that our value offer came from enabling communities to raise funds. However, over the years we have increased the support and features for the second part of that money’s lifecycle - to ‘manage and spend’. We were charging a fee for a part of our service while investing a lot of time and effort on a different one that was going along for the ride. We need to change this!

To add complexity, because we have restricted ourselves to service collectives for whom we are solving the existential need to fundraise without a legal entity, we traditionally focused more on serving existing fiscal host non-profits, for whom we now find ourselves with a suboptimal pricing scheme.

As a result we are taking a hard look at our business model. We begin by returning to our vision. Open Collective centers transparency because transparency enables collectivity. Just look at GitHub. If the code for an open source project was not open, no one would be able to contribute. And why collectivity? Collectivity is resilience. We are stronger together than we are alone.

What does this mean? We open up our addressable market significantly, to include all communities (ie. groups of individuals that operate with their own bank accounts - think former Braid groups), projects, and organizations outside of the fiscal hosting paradigm. And we offer them a compelling pricing for the cash and expense management tooling, where we have become increasingly competitive in the community tech space. We use this new revenue to give current fiscal hosts on the platform a more competitive offer.

Revenue

The challenging bit of all this is growing the addressable market to untapped organizations, collaboratives and individuals while serving our current, core business of fiscal host organizations. Fiscal hosts are at the center of everything for Open Collective, both in terms of fees and in driving tipping activity. We can’t just sweep them off the table and begin serving someone else. But in order to move into the future, we need to recompile our commercial relationship with them.

We are reviewing our existing relationship and adjusting where needed to maintain alignment (SLAs tailored to their needs.) We may continue to provide additional services (access to internal data queries and dashboards, developers support time, managing their IT services), products & functionalities (engineering and product time on their requests and priorities, priority roadmap access and positioning, tailored features, etc), and intangibles (OC brand and goodwill, my own network and fundraising efforts, etc) previously included in our shared revenue model. This is essentially an “enterprise” custom pricing tier.

We will release a SaaS pricing model for smaller organizations and independent collectives already on the platform that feels right and delivers value. With the previous pricing model, their 0% host fee meant that they often used the platform for free. While we will still have room for some free usage of the platform, and will treat the transition with care, we can offer them something worth paying for. This new standardized pricing model will help us bring Open Collective to a wider audience of organizations. It is possible that we will experience a temporary dip or plateau in revenue as part of this transition, but we believe in the value of what we are offering and have adjusted our operational costs accordingly, while still taking care of our own and investing in the future.

Team News

As part of growing the team into leadership positions, Nathan Hewitt is stepping into the COO role as of January 1st. Join me in congratulating him!

As part of our cost saving plans to help us shift revenue models:

Ben Nickolls has shifted the bulk of his time from OC Inc. to focus on Open Source Collective effective January 1, 2024.and

Caroline Woolard has asked to transition out of her role at OC Inc. to focus on her work at Art.coop effective December 31, 2023. She will remain on a contract to do fundraising and research related to the new nonprofit, currently named Collectively Open.

Corporate News

Ben Nickolls will join the OC Inc. Board as Treasurer and continue to dedicate some time to support the product team and processes.

Pending a shareholder vote, OC Inc. will become a Public Benefit Corporation where maintaining the mission of OC Inc. is just as important as driving profit.

We remain committed to an Exit to Community in the future, and will explore ways that some sort of exit-to-community “moment” can strengthen Open Collective’s position and give us access to new capital as we implement a new pricing model and broaden our focus. I'll share more on this as we make some progress in our thinking.

As usual, thank you so much for walking this journey with us and thank you to all of you who helped me ride a particularly challenging year for me personally and for OC. Please do let me know if you have any questions or ideas to help us move forward faster! --

Pia Mancini and the Open Collective Team