Charity Fundholding for NZ: Gift Collective

We need accessible, affordable, effective fundholding for charitable initiatives, which powers them up instead of weighing them down.

My friend Sid rang me, very excited but also freaking out: "I got the grant! But now I don't know what to do."

The council had approved funding for the community art initiative he'd dreamed of. Sid is incredibly talented at community building and creativity, so I had no doubt he'd do a fantastic job. And as a fellow resident, I was excited to have his initiative in the neighbourhood.

Here's the problem

A grant for community art is not just about art and community. There's all kinds of admin involved: accounting, taxes, compliance, record-keeping, reporting, payments, etc. Sid finds this kind of work quite stressful, and doing it would sap a lot of his energy.

The grant was large enough to complicate his income tax if he put it in his personal account, assuming the council even allowed that, yet not large enough to justify incorporating and registering his own charity—which in any case would take too long, be too expensive, and require even more admin.

He had to tell them where to send the money. Who knew a form field labelled "bank account details" could cause so many issues?

This kind of thing comes up a lot:

- Time limited projects where it doesn't make sense to set up a whole new entity.

- Young activists and community change-makers who lack the know-how to establish and manage their own charity.

- A successful crowdfunding campaign seeking a place to put the money and offer accountability to backers.

- An unincorporated group like a meetup, needing to fundraise or sign a contract, e.g. with a venue or sponsor.

- A newly forming charity, if they want to accept funding while they wait for registration, or from funders requiring a longer track record.

So, what to do?

Let's get back to Sid: "A charity offered to be my fundholder, but they want to take 30%. I won't have enough left for the project."

Fundholding is where an existing charity holds money for an initiative without its own entity. In Aotearoa NZ, we don't have many good fundholding options. People scramble to find a charity willing to take them, and if they can't find one, or have to give up a big cut, they're out of luck.

Charities often charge high fees for fundholding for good reason. It's a distraction from their main mission and can involve a lot of overhead, liability, and compliance, requiring extra capacity many charities can't easily afford.

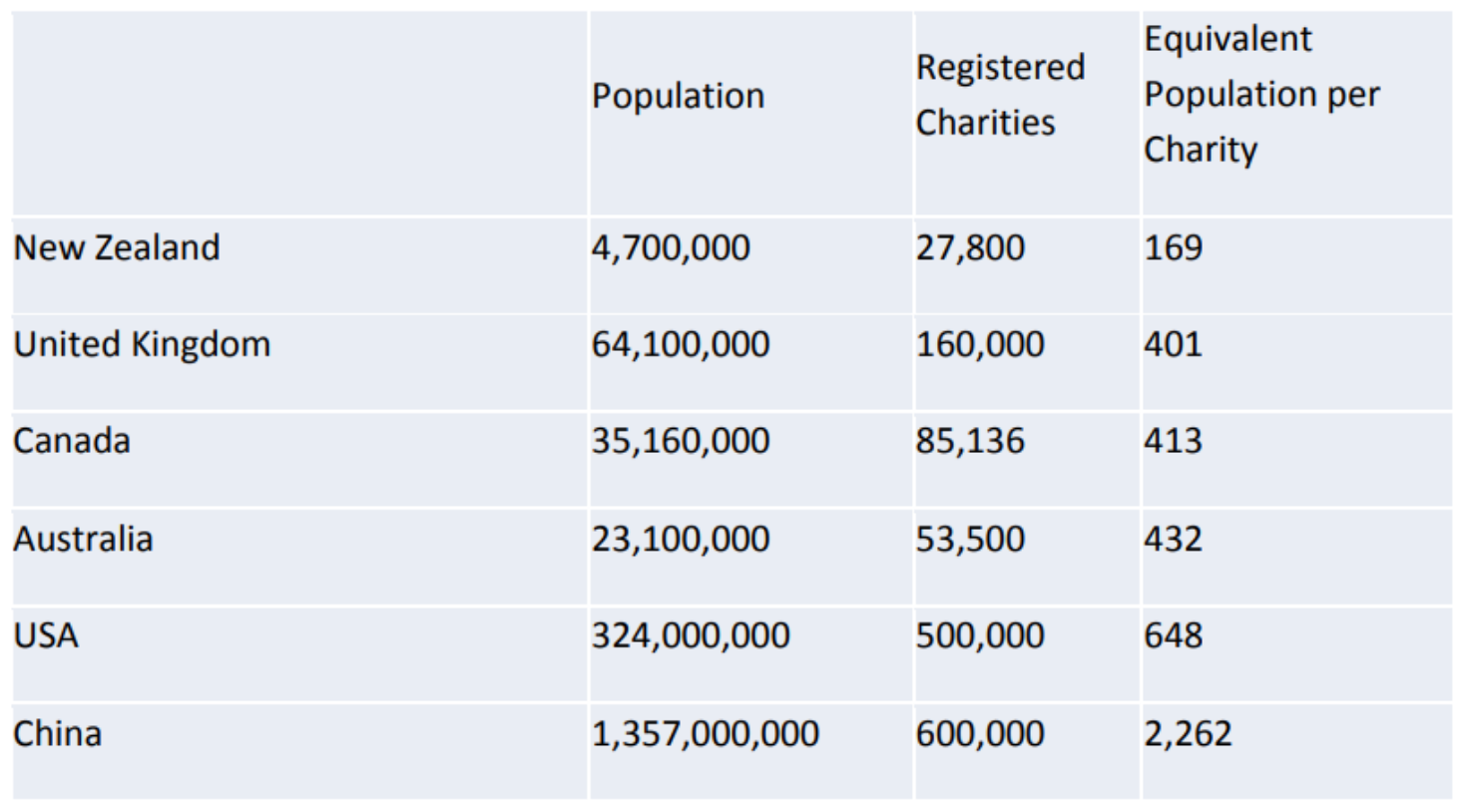

So, often, people start their own charity. In fact, Aotearoa NZ has the most charities per capita in the world. Every single one represents someone's energy to make a difference instead spent on filling out forms—every hour doing admin is an hour less for the important mahi.

This is a problem for funders as well. Grant-makers, such as philanthropic foundations and local councils, don't want to weigh initiatives down unnecessarily, but they must ensure money is spent appropriately. Some are restricted to funding only registered charities with an established track record, putting many initiatives out of their reach.

At the same time as we have too many redundant charities forming to accept funding, how many other initiatives never get funded at all because of these barriers?

We need accessible, affordable, effective fundholding for charitable initiatives, which powers them up instead of weighing them down.

Sid's predicament further fuelled my motivation to bring my overseas fundholding work home.

Here's a solution

I'm executive director (remotely from NZ) of a US nonprofit fiscal sponsor entity, the Open Collective Foundation, providing charity fundholding services. In 2020, we raised over US$ 4.5 million for nearly 200 charitable initiatives: providing mutual aid during the pandemic, fighting climate change, protecting privacy and freedom online, promoting black leadership in technology, entrepreneurship, and justice reform.

We provide donor tax benefits, enable access to professional advice (accountants and lawyers), and meet compliance requirements, combining financial and legal services with a powerful tech platform. It has features for transparent budget tracking, expense and payment management, automated reporting, crowdfunding, and community engagement.

Now I'm creating a similar service for Aotearoa NZ. To make it happen, I've founded Open Collective NZ and partnered up with an established local charitable trust and donor advised fund, The Gift Trust. Together, we're launching Gift Collective.

Since charity fundholding is our sole mission, and thanks to the existing structures of The Gift Trust and the efficiency of the Open Collective platform, Gift Collective's fees are much lower: just 8%.

Initiatives can keep focused on their kaupapa and mahi, while we handle all the admin and regulatory requirements. No need to register with Charities Services or open a new bank account. The Gift Trust, with its deep expertise in analysing charities, vets every initiative to ensure that it is genuinely charitable, and holds the funds in its bank account.

Initiatives can get up and running right away, ready to receive grants and provide donation tax receipts.

Funded initiatives manage their budgets online, transparently, putting their money at their fingertips. The platform enables incoming and outgoing payments by credit card, PayPal, and bank transfer, ensures proper documentation and review for all expenditures.

Gift Collective offers a range of benefits to funders as well. Built-in budget transparency means realtime, automated reporting with no extra burden. Initiatives that would otherwise struggle to meet grant requirements can be funded. We can provide a neutral space to gather and distribute coalition funding (like this), and we drastically reduce the overhead of giving many small grants—with a single contract and financial transfer, and we can disburse to numerous recipients (like this).

Funded initiatives can augment an initial grant with crowdfunding and other revenue streams, supporting their long-term sustainability. Ultimately, funders want less going to overheads and more going to impact, just like initiatives do, so it's a win-win.

Whether you're a group seeking funding, a funder looking to reach further, or about to get a grant and don't know where to put it, Gift Collective is here to help!

Our Aspiration

So what happened with Sid? After hearing about our low fees, he went back the charity he'd been working with, counter-offer in hand, and worked out a much more favourable deal. This was a win to me, even though he ended up with a different fundholder.

We seek to catalyse fundholding for the whole community, making it more accessible, more efficient, more transparent, and more common.

While we think there's a real gap for a specialist charity fundholding service like Gift Collective, it's only one part of the picture. Any existing entity can plug the Open Collective platform into their bank account to manage fundholding, improving the whole process and enabling all the useful online features. No more messy spreadsheets and Xero tracking codes! Open Collective NZ is also offering a parallel fundholding service for non-charitable initiatives, under the umbrella of a limited company.

Finally, we are partnering with others to develop shareable legal templates and best practice guidance for fundholding. If you're interested, come along to an open discussion about fundholding in Aotearoa on 12 Feb.